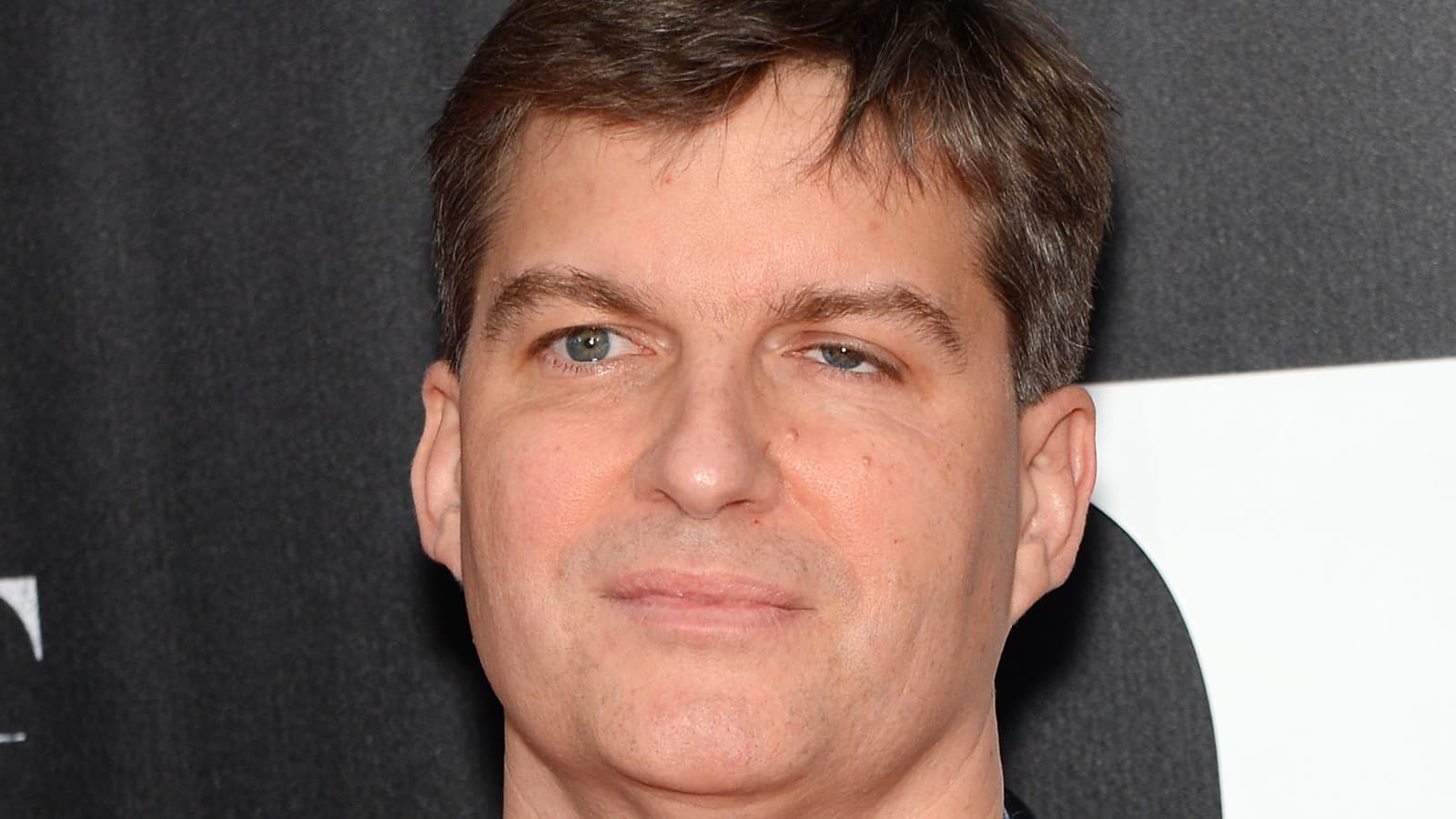

Michael Burry Net Worth: How The Big Short Investor Made His Fortune

Is it possible for a single individual to foresee and profit from the collapse of an entire financial market? For Michael Burry, the answer was a resounding yes, and his story is a testament to the power of independent analysis and the courage to challenge conventional wisdom.

Born on June 19, 1971, Michael James Burry, the American investor and hedge fund manager, has carved a unique path through the world of finance. He gained prominence by accurately predicting and profiting from the subprime mortgage crisis of 2008, a feat that earned him both financial rewards and a prominent place in financial history. Burry's journey began with a foundation in medicine, but his passion for investing ultimately led him to establish Scion Capital, now known as Scion Asset Management. This shift underscores his remarkable ability to analyze complex data and identify opportunities often overlooked by the mainstream.

Burry's investment strategies, characterized by contrarian thinking and a meticulous approach to research, have made him a subject of both admiration and scrutiny. His ability to spot overvalued markets and bet against them has led to substantial returns, but also to periods of significant volatility and the challenge of maintaining conviction in the face of market pressure. This article delves into the life, career, and enduring legacy of Michael Burry, exploring how he amassed his fortune, the strategies he employed, and the impact he has had on the investment world.

| Category | Details |

|---|---|

| Full Name | Michael James Burry |

| Born | June 19, 1971 |

| Nationality | American |

| Profession | Investor, Hedge Fund Manager, Physician |

| Education | University of California, Los Angeles (UCLA) - B.A., M.D. |

| Known For | Predicting and profiting from the 2008 subprime mortgage crisis, investments in Gamestop. |

| Founder of | Scion Capital LLC (now Scion Asset Management) |

| Net Worth (Estimated) | $300 Million (As of early 2025) |

| Key Investments | Gold, Water, Agricultural Land, and various public companies. |

| Notable Role | Portrayed by Christian Bale in the film "The Big Short." |

| Personal Interests | Heavy Metal Music (Specifically, bands like Obituary, King Diamond, Pantera, Amon Amarth, and Slipknot) |

| Website Reference | Investopedia - Michael Burry |

Michael Burry's journey is more than just a financial success story; it's a narrative of intellectual curiosity, independent thinking, and the courage to stand apart. He initially pursued a career in medicine, earning his M.D. from UCLA. This background instilled in him a rigorous analytical approach, which he later applied to financial markets. His transition into finance, however, was not a conventional one. Lacking formal training in finance, Burry started his investment journey by writing about his stock picks on the internet, showcasing his analytical abilities to a wider audience. He earned a loyal following for his insightful stock picks and in-depth analyses, using his medical background to analyze companies and detect anomalies, ultimately founding Scion Capital in 2000.

His early investments demonstrated a knack for identifying undervalued assets and understanding the intricacies of financial statements. He soon gained recognition for his stock picks and financial acumen. Burry's approach set him apart from the prevailing investment strategies of the time. This was instrumental in preparing him for his most defining success: identifying the impending collapse of the subprime mortgage market.

The seeds of Burry's fame were sown during the early to mid-2000s. He became convinced that the subprime mortgage market was built on shaky foundations, with mortgages being issued to borrowers with poor credit histories. Burry meticulously analyzed the complex financial instruments known as collateralized debt obligations (CDOs), which bundled these high-risk mortgages. His research revealed a ticking time bomb. He recognized the inherent fragility of these CDOs and the potential for widespread defaults when the housing market inevitably slowed down. While many investors were optimistic about the housing market, Burry began to bet against it. This wasn't a popular stance. The prevailing sentiment was that the housing market would continue to rise, and those who questioned it were often dismissed. However, Burry's research told a different story.

Burry decided to profit from the impending collapse by investing in credit default swaps, a type of insurance on these CDOs. He saw this as a way to protect himself and profit from the inevitable decline. He faced enormous skepticism from within the financial industry. Other investors questioned his analysis, and his fund faced significant redemptions as investors worried about his unconventional positions. Many of his peers, accustomed to traditional investment strategies, struggled to grasp his unconventional approach. This required immense courage and conviction, as he risked his fund's reputation and his personal wealth on his analysis. He persevered, knowing that the market's overconfidence would eventually lead to a reckoning. The complexity of the financial instruments and the prevailing market sentiment made it difficult to communicate his concerns and strategies. He encountered significant resistance from the institutions he dealt with. However, his belief in his analysis never wavered.

His foresight proved accurate when the subprime mortgage market began to crumble in 2007 and 2008. The housing market crashed, and defaults on subprime mortgages soared, triggering a global financial crisis. Burry's bets against the market paid off handsomely. His fund, Scion Capital, generated massive profits for its investors, making him a multi-millionaire. This success catapulted him to financial stardom, cementing his reputation as one of the most astute investors of his generation.

The 2008 financial crisis and Burry's role in it became the subject of Michael Lewis's book, "The Big Short: Inside the Doomsday Machine," and the subsequent film adaptation, "The Big Short," where he was portrayed by Christian Bale. This portrayal brought his story to a global audience, making his strategies and insights accessible to a wider public. The film and the book brought his story to a much wider audience. The movie adaptation further popularized his story. This added another layer to his legacy, making his story a key part of the financial crisis narrative.

While his initial success was based on his understanding of the subprime mortgage market, Burry's influence has extended to other areas of the financial world. After the financial crisis, he closed his hedge fund, Scion Capital, in 2008 and took a break from public investing. Yet, his passion for investing never diminished. He continued to make investments, often in overlooked sectors or companies that he believed were undervalued by the market. He has continued to actively manage investments, albeit with a lower public profile. Burry's more recent investments have included companies he believes can withstand economic downturns. He has also shown interest in sectors like water and agricultural land, reflecting his long-term outlook and concern about resource scarcity.

His approach to investing remains consistent: finding value where others don't. His strategy is characterized by a deep understanding of the underlying fundamentals of a business, a contrarian approach, and a willingness to challenge the prevailing market narratives. This requires him to thoroughly understand the economics of the businesses he invests in, not just the market sentiment. He carefully evaluates companies, looking for those whose intrinsic value is higher than their market value. He's known for his patience, buying and holding assets for long periods, as he believes that long-term value will ultimately be recognized by the market. He often identifies companies that are facing temporary setbacks or are undervalued due to market irrationality.

Burry's investing decisions, while successful, have not always been without risk. His investment in GameStop, for example, created a stir when he invested in the video game retailer before the meme stock frenzy. He recognized the value in the company, but he sold his shares before the massive price surge driven by social media. He acknowledged the changing market dynamics and adapted his strategy accordingly. The Gamestop experience showcased how quickly market dynamics can change, and the importance of staying adaptable in a rapidly evolving investment landscape. This highlighted the need to remain flexible and responsive to market shifts. He later sold his stake in GameStop before the massive surge driven by social media and retail investors. While he profited from the investment, he missed out on the dramatic spike that followed. This underlines the difficulty in predicting market sentiment and the importance of sticking to your core investment strategy.

Beyond his investments, Burry's personal interests provide a glimpse into the man behind the financial genius. He has a keen interest in music, especially heavy metal. He has publicly expressed his admiration for bands like Obituary, King Diamond, Pantera, Amon Amarth, and Slipknot. This interest offers a view into his character outside of the financial world. His eclectic tastes show his interests, and that there is more to him than just his financial acumen. This shows his diverse interests and provides a more complete picture of his personality.

As of early 2025, Michael Burry's net worth is estimated to be around $300 million. This figure is a testament to his successful investment strategies. The source of this wealth is primarily derived from his investments, both through his hedge fund and his personal investments. This represents the culmination of his years of financial analysis and contrarian thinking. He has navigated market cycles and economic fluctuations effectively. While the exact details of his current portfolio are not always public, the consistency of his success points to a disciplined and well-considered approach to investing. This success is a direct result of his commitment to value investing, contrarian thinking, and deep financial analysis. He has continued to demonstrate the ability to find value in the market, and that makes him an active investor.

Burry's legacy extends beyond his financial achievements. He has become a symbol of intellectual curiosity, the importance of independent thinking, and the power of challenging conventional wisdom. His story encourages investors of all levels to adopt a disciplined approach to investing. His experience serves as an example of what can be achieved through persistent dedication and the confidence to go against the flow. He shows that there's value in questioning established beliefs and rigorously evaluating information.

Michael Burry's journey exemplifies how recognizing opportunities in the market can lead to substantial gains, especially when combined with the courage to go against popular opinion. He proved that meticulous research, a strong analytical mind, and the conviction to act on one's beliefs could lead to incredible success. His investment strategy, and his personality, remain compelling in the financial world.