SERS Ohio: Your Guide To Retirement Benefits & Planning

Are you a school employee in Ohio, diligently serving your community, and pondering the path to a secure retirement? The School Employees Retirement System of Ohio (SERS) is the cornerstone of financial stability for countless individuals who dedicate their lives to supporting Ohio's educational institutions.

The journey towards retirement within the SERS system is often complex, with various factors influencing the benefits available. School employees, the unsung heroes of the Ohio public school system, often find themselves navigating intricate regulations and eligibility requirements. SERS provides retirement allowances, disability and survivor benefits, and access to health care coverage. It's a system designed to provide a safety net, but understanding its intricacies is crucial for maximizing its benefits. In some instances, school employees leave employment before reaching their eligibility age, perhaps delaying their filing for service retirement until they reach 62 or 65, often with the assumption that they should apply concurrently with their Social Security benefits. This underscores the importance of early and consistent engagement with SERS resources.

Lets delve into the core of this system and dissect how it works, what it offers, and how you, as a dedicated school employee, can benefit from the School Employees Retirement System of Ohio.

| Category | Details |

|---|---|

| System Name | School Employees Retirement System of Ohio (SERS) |

| Establishment Date | 1937 |

| Primary Function | Provides retirement allowances, disability & survivor benefits, and access to health care coverage for Ohio's school employees. |

| Membership | Members of the School Employee Retirement System (SERS) are the unsung heroes of the ohio public school system. |

| Retirement Options | Two main types: Unreduced service retirement and early service retirement with reduced benefits. |

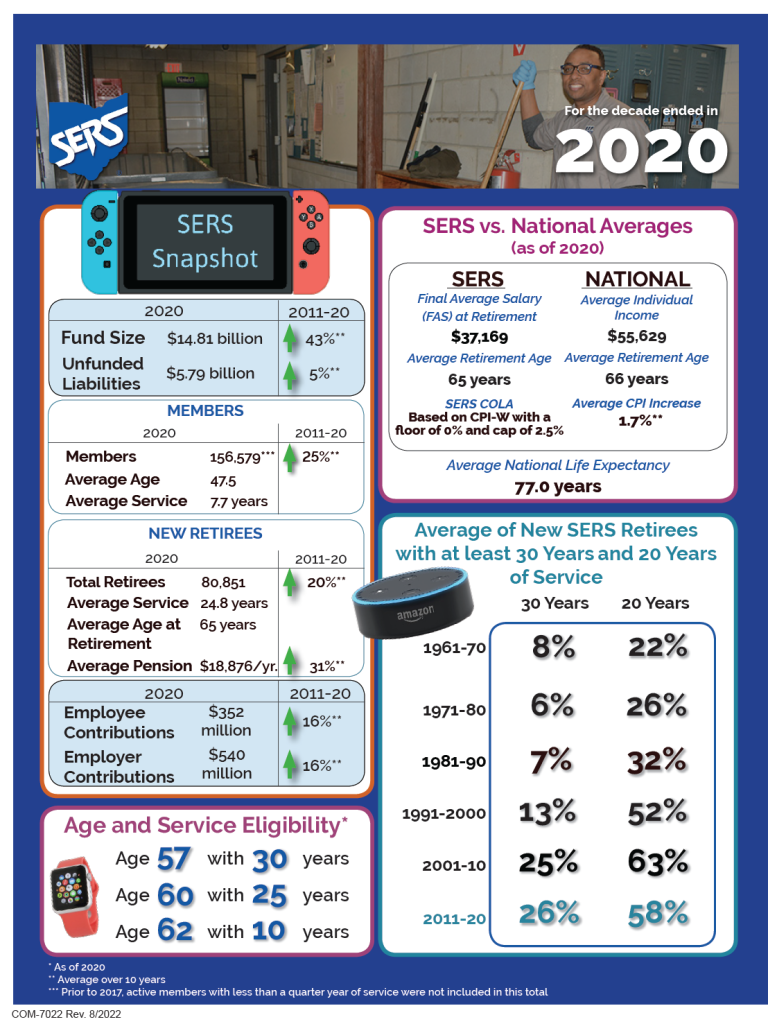

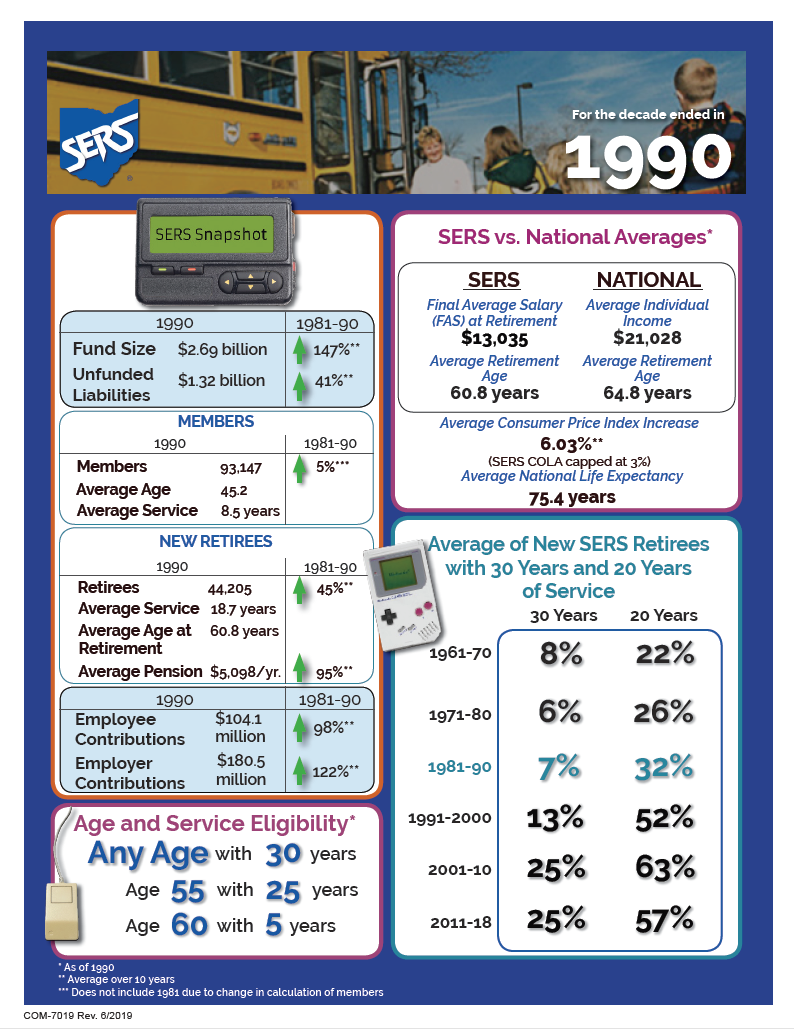

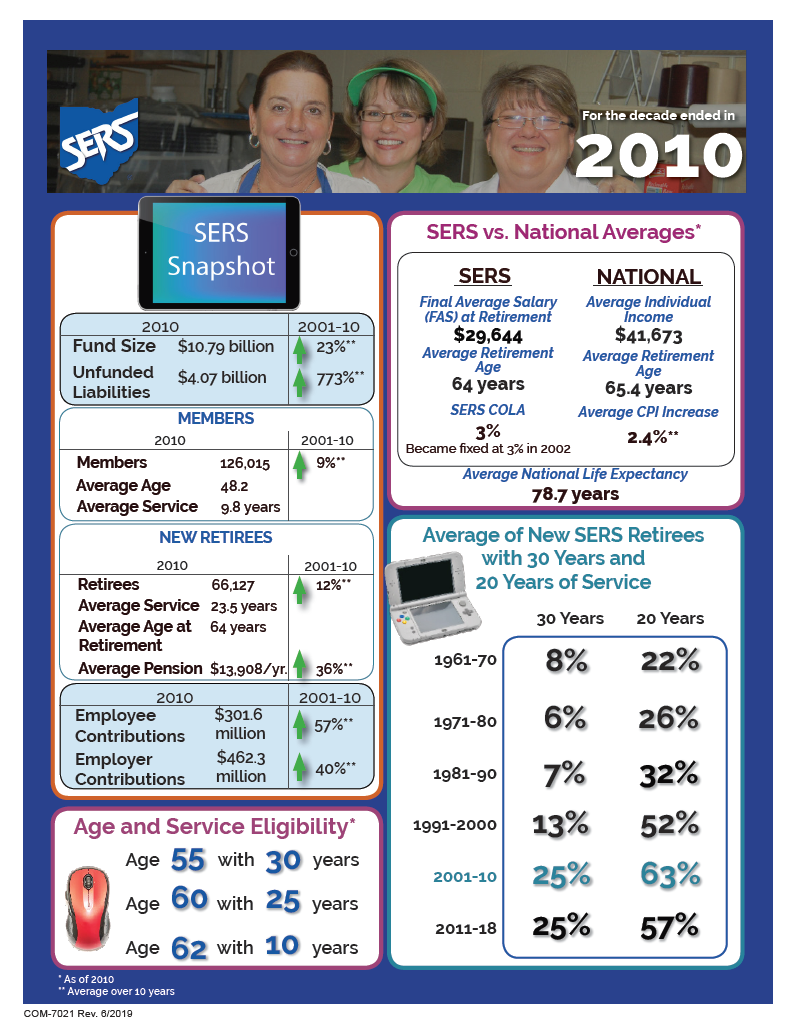

| Benefit Calculation | Based on service credit (length of employment) and final average salary (average of the three highest years of salary). |

| Additional Coverage | Offers dental and vision coverage through Delta Dental of Ohio and VSP Vision Care. |

| Key Legislation Affecting Benefits | The Social Security Fairness Act, signed into law on January 5, 2025, repealed the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO), impacting over 3 million public workers. |

| Transparency and Financial Information | Publishes financial documents, including administrative expense reports monthly and annually, demonstrating a commitment to transparency. |

| Resources and Guides | Provides numerous forms and publications, including retirement, enrollment, and healthcare guides, tax and pension information, newsletters, and info handouts to assist retirees and employers. |

| Contact Information | For contact information, please visit the SERS website. |

| Official Website Reference | School Employees Retirement System of Ohio (SERS) |

Navigating the SERS system begins with understanding eligibility. Who qualifies as an SERS member? Generally, it encompasses non-teaching employees of Ohios public school districts, educational service centers, and certain other educational entities. Their roles, though varied, are crucial to the smooth operation of schools, ensuring student safety and a conducive learning environment. These individuals are the bedrock upon which the success of Ohio's educational system is built.

SERS offers two primary types of service retirement. Unreduced service retirement allows members to receive the maximum pension amount based on their service credit and final average salary. The longer you've worked in an Ohio public service job (your service credit) and the average of your three highest earning years (final average salary) directly impacts your pension. Then there's early service retirement, which provides a path for those who wish to retire before they meet the requirements for unreduced benefits. This, however, typically involves reduced benefits.

A significant aspect of retirement planning involves service credit. Your service credit directly affects your final pension amount. This is a crucial factor in determining your financial security during retirement. Restoring service credit after a refund is an option for those who may have had a break in their employment but wish to regain those years towards their retirement.

In 2024, SERS implemented a Contribution-Based Benefit Cap (CBBC) calculation to prevent pension spiking. This measure ensures that the system remains financially sustainable by setting limits on the highest possible pension amounts. Understanding how the CBBC affects your potential retirement benefit, and knowing how to check your status through the SERS website, is essential for informed planning.

Healthcare coverage is another essential component of SERS benefits. Members have access to health care coverage, including dental and vision plans. These plans are available through Delta Dental of Ohio and VSP Vision Care. To enroll in dental and/or vision coverage, you must meet the eligibility criteria, although enrollment in SERS' healthcare coverage is not a prerequisite.

The School Employees Retirement System of Ohio (SERS) was established in 1937 and has a proud history. The organization is committed to financial stewardship and is designed to safeguard the hard-earned contributions of its members and employers. It offers a comprehensive package designed to provide security and peace of mind for those who have dedicated their careers to public service in Ohio.

The Social Security Fairness Act, signed into law on January 5, 2025, by President Joe Biden, holds great significance for many SERS members. This Act repealed the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). These provisions had a significant impact on the benefits of over three million public workers, ensuring that these individuals receive more of the benefits they are entitled to. Understanding the implications of this act is crucial for those navigating the complexities of their retirement benefits.

For those seeking additional support, SERS collaborates with other organizations. For example, the School Employee Retirement Organization (SERO) is a voluntary organization, founded in June 1978, dedicated solely to benefit the retired and contributing members of SERS. SERO provides supplemental benefits, discounts, news, and advocacy. It offers resources, events, and a network of support for those planning for and enjoying their retirement.

If you're a retiree, SERS provides a wealth of resources to help you make the most of your retirement, including information on reemployment and social security. The system also publishes financial documents and archives of past financial information to maintain transparency. This includes administrative expense reports in both summary and detailed formats, published monthly and annually, demonstrating a commitment to financial accountability and openness. SERS strives to maintain open communication with its members and the public.

When you enroll in an Aetna Medicare plan, you can expect comprehensive coverage and support. Aetna and SERS work to provide a seamless experience, so you can concentrate on enjoying your retirement years. With this, the SERS strives to be a reliable source of information and support for its members throughout their retirement journey.

The School Employees Retirement System (SERS) is the cornerstone of financial security for Ohio's school employees. With its diverse offerings, from retirement allowances to healthcare coverage and supplemental benefits, SERS supports members throughout their careers and into retirement. By understanding the details of the system, staying informed about policy changes, and actively engaging with SERS resources, school employees can secure a fulfilling and financially stable retirement. Its a system designed to provide peace of mind, allowing members to embrace their retirement years with confidence and security. It's not just about retirement; it's about securing the future you deserve, one built on years of dedicated service to Ohio's children and communities.